6 Unforgettable Crypto Fallouts of 2022

We've seen many twisted events in crypto this year (2022). Learn cogent financial lessons from the stories behind the most unforgettable crypto failures of 2022.

We've seen many twisted events in crypto this year (2022). Some people profited, while others counted their losses. But while this is normal for any market, some crypto events we witnessed this year were just shockingly unfortunate. Starting our count from the Luna crash down to the FTX saga, among many others, the surprises kept coming.

As 2022 rolls out, we'll look into some of the unforgettable crypto failures of the year. You may know some of these already. But the stories behind them will teach you some crypto financial lessons.

1. Terra/Luna's Crash

The Luna crash was the most brutal, emotional, and shocking fallout in crypto's history. The Terra blockchain was created in 2018 by Do Kwon and Daniel Shin of Terraform labs. Of course, the Terra chain ruled its world for four years until its abrupt shipwreck in May 2022.

In a black swan event, Luna crashed from $102 to $0.02 and down to almost zero between May 11 and 12, 2022.

Why Did Luna Crash?

The Terra network managed the Luna coin as its native cryptocurrency and UST as its stablecoin. However, the team sought to make a difference by pegging the UST to an algorithmic stablecoin rather than backing Luna's volatility with actual cash (USD). Hence, investors could exchange one Luna coin for its price in UST regardless of UST price relative to USD.

This means UST could slip below the USD, and you could still convert its value by exchanging it for $1 worth of Luna. You can then exchange your Luna coin for USD on a marketplace. Terra had to strive to keep UST on the same level as the USD. Hence, the essence of the blockchain was at stake.

It soon became apparent that Terra's reserve wasn't enough to prevent UST's liquidity. According to a report on CoinMarketCap, hundreds of millions of UST liquidated on May 7, 2022, causing it to plummet to as low as $0.044. It's unclear whether this was due to an attack or a chain protocol. Many investors started exchanging the crashed UST for Luna. The Luna coin started circulating the market in throve, dipping its price from $80 to only some cents.

In a final blow, crypto exchange platforms started delisting Luna and UST. And before we knew it, the Luna/UST era became history altogether. According to a report available on BBC, Interpol would later issue an arrest warrant on Terra's founder, Do Kwon.

The Luna crash had a negative and lasting impact on the entire cryptocurrency market. Indeed, the crypto economy is still struggling to make a comeback. Although this winter might extend, we're optimistic the market will be bullish in the coming year.

2. Three Arrows Capital (3AC) Shutdown

Luna didn't go down without taking some associated firms with it. Just when we thought we were over the horrendous Luna night, the dawn of July came with the shocking collapse of one of the most prominent crypto hedge funds, 3 Arrows Capital (3AC).

Summarily, 3AC gambled its way into the crypto market despite experts' skepticism of its pre-crypto operations. It later went bankrupt in July after plunging into unaffordable debt.

How Did 3AC Crash?

Three Arrows Capital got involved long-term with many cryptocurrencies excessively. However, the hedge fund, founded in 2012 by Kyle Davies and Su Zhu, had a previous parol with the embattled Luna. And this was what caused its abrupt bankruptcy and subsequent shutdown.

A report available on Fortune confirms that 3AC had invested in over $200 million worth of the crashed token. Unfortunately, like many other investors, it couldn't recover its funds from the defunct token.

Zhu and Davies, 3AC founders, had been previously involved in currency arbitrage before venturing into a cryptocurrency hedge fund. The duo soon felt the crypto market weight when 3AC ventured into unaffordable debts. The company gambled into the ditch along the way. And the Financial Times reported on June 16, 2022, that 3AC had failed to meet its lender's margin call.

While the Luna crash seemed like a blow to 3AC, other salient debts relating to general mismanagement contributed to its fall. The Wall Street Journal also reported that Three Arrows Capital had borrowed $660 million in loans from Voyager Digital, a crypto brokerage, but couldn't repay this debt. As it accrued huge debt, 3AC later filed for Chapter 15 bankruptcy protection on July 1, 2022—to protect it from paying back creditors.

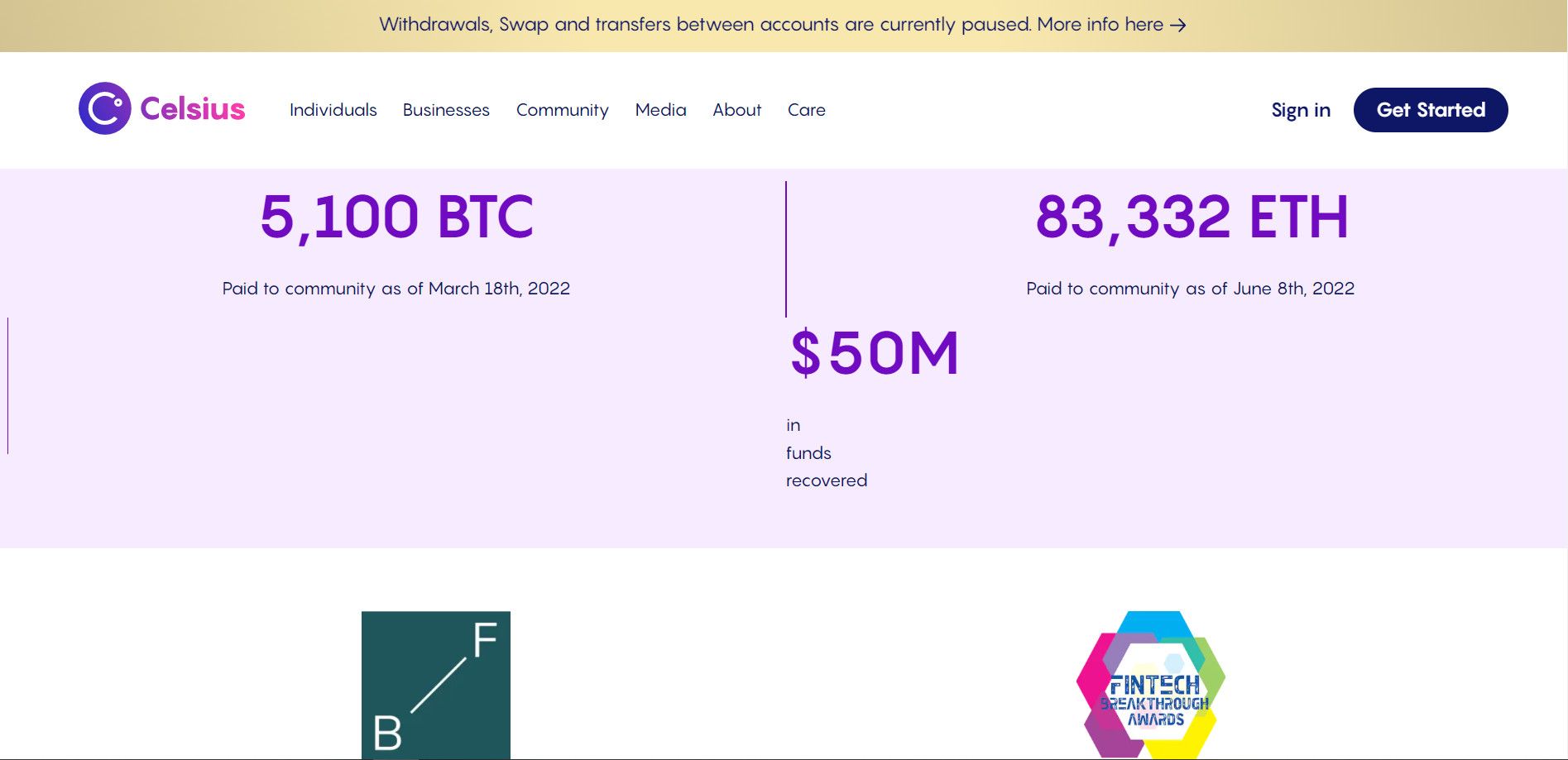

3. The Celcius Network Crash

The Celcius Network's crash was due to its long battle with insolvency, among many other related crises. Celcius Network is a crypto-lending and interest-bearing Defi platform stationed in New Jersey.

The firm's troubles didn't surface until Luna crashed in May 2022, as the lending platform later attributed its bankruptcy to the excessive withdrawals it witnessed from Luna's excessive circulation.

However, it seemed the company had started envisaging a sinister when it stated in its April 11 Medium blog that it would now withhold coins belonging to unaccredited investors.

By June 12, 2022, Celcius Network announced that it was pausing all withdrawals, token swaps, and transfers from its platform to "stabilize liquidity and protect assets." Customers took to their Twitter handles to express dissatisfaction as the company withheld its well over 1 million customers' assets indefinitely.

I had a $15,000 loan liquidated by Celsius. I was in the process of transferring funds and they froze withdrawals and transfers anyway and liquidated my loan. The worst of it is I did throw good money and got stuck. Please do NOT send any of your money toward Celsius.

— Global Village (@SujeevanSegaram) July 1, 2022

The Celcius Network crash was gradual and affected its staff as far as it did customers. According to Blockworks, the company laid off 150 employees in its bid to protect users' interests in the wake of July 2022. The firm would file for bankruptcy on July 13, a day after Coindesk gathered that Celcius Network had paid off its $10 million debt to Aave, a Defi protocol lender.

4. FTX Bankruptcy

The FTX bankruptcy and its link to its founder, Sam Bankman-Fried (SBF), is the most prominent crypto news capping the year. Until its abrupt shipwreck on November 11, 2022, FTX was the second-largest crypto exchange platform—only trailing behind Binance in popularity.

How Did FTX Crash?

There were signs the exchange platform couldn't hold off before the bankruptcy, as the firm's CEO admitted that its reserve couldn't meet customers' withdrawal requests. There was a liquidity crunch, and FTX halted withdrawals. Customers finally lost hope in FTX when SBF tweeted that it was already speaking with Changpeng Zhao, Binance's CEO, on a possible acquisition of FTX.

1) Hey all: I have a few announcements to make.

— SBF (@SBF_FTX) November 8, 2022

Things have come full circle, and https://t.co/DWPOotRHcX’s first, and last, investors are the same: we have come to an agreement on a strategic transaction with Binance for https://t.co/DWPOotRHcX (pending DD etc.).

FTX's deal with Binance didn't go as planned, as the buyer spotted the danger behind the acquisition. Binance maintained in a tweet that it's holding back due to fund mismanagement and an ongoing investigation on FTX. It became clear at this point that FTX was going to the trenches.

As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of https://t.co/FQ3MIG381f.

— Binance (@binance) November 9, 2022

Then the FUD began. There were more withdrawals than deposits until it was clear that FTX wasn't solvent enough to handle such a withdrawal surge. SBF filed for Chapter 11 bankruptcy protection on November 11, 2022, after this realization.

Hours after filing for bankruptcy, Elliptic Connect reported an unauthorized transfer of $477 million from FTX in a possible hack. Customers got locked out and couldn't access the exchange platform. According to an exposition available on Reuters, SBF channeled $10 billion in funds to FTX's sister company, Alameda Research, leading to a disappearance of $1 billion in customers' funds.

The FTX case remains in court as of writing, and SBF, its CEO, and many other associated top staff face countless fraud-related criminal charges.

The Aftermath of the FTX Crash

FTX also housed many prominent investors' funds, including Solana. Experts believe the FTX crash affected the Solana ecosystem significantly and may be the cause of the Solana dip. Besides, many customers kept tokens, including NFTs, on the platform. So its crash was a disaster for many crypto businesses, including NFTs. You can also read our take on the effect of the FTX crash on the Solana NFT market.

Customers have also started losing trust in crypto exchange platforms altogether since the FTX collapse. Other trading platforms have started adopting what they call the proof of reserves to bridge this trust gap, while experts call for the regulation of the crypto market.

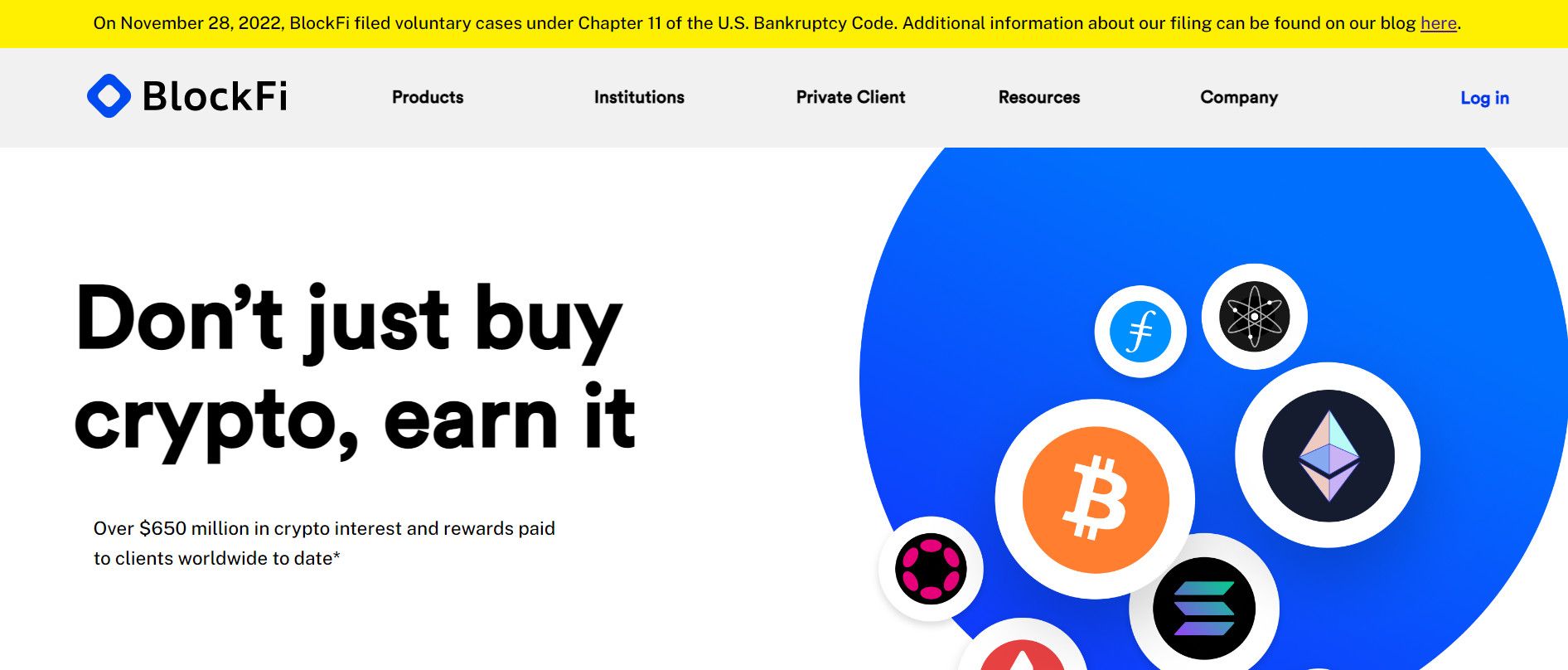

5. BlockFi's Crash

The FTX crash affected companies like BlockFi directly. In its press release on November 28, 2022, BlockFi, a small-scale digital asset lending company based in New Jersey, filed for Chapter 11 bankruptcy barely two weeks post-FTX crash.

BlockFi vehemently stated in its press release that its bankruptcy was due to its direct association with FTX.

BlockFi's troubles started in June 2022, when it faced a liquidity crisis due to the collapse of Three Arrows capital (3AC). In a report by Bloomberg, Sam Bankman-Fried, FTX's CEO, seized this opportunity to buy the company, offering a bailout fund of $400 million; a loan BlockFi could access any time.

Of course, the bailout couldn't hold BlockFi any more post-FTX bankruptcy. As soon as FTX, its savior, crashed abruptly, BlockFi also went down due to over-dependence on FTX.

BlockFi had perceived the impending trouble the FTX crash meant for its smooth operation before its crash. Barely three days after FTX filed for bankruptcy, BlockFi paused all withdrawals on its platform and advised customers to desist from depositing funds.

Below is an extract from BlockFi's November 14 press release addressing customers' withdrawals and deposits.

6. Core Scientific's Bankruptcy

Core Scientific's bankruptcy is the most recent blow to hit the Bitcoin mining market. Core Scientific is one of the most prominent Bitcoin mining companies in the U.S., contributing a 10% quota to the entire mining computing power.

The firm filed for Chapter 11 bankruptcy on December 22, 2022, citing fallen revenue, increasing energy costs, and the bearish market as reasons behind its fall. However, according to a report on CNBC, the mining company kept mining while the process was underway.

You can read more about Core Scientific's bankruptcy in our previous blog.

What to Expect in the Coming Year?

Crypto news is as volatile as its market. While many experts predict persistent winter, others opine that it might clear off in the coming year. Although there are signs of revelations about crypto's volatility, no one can boldly say how things will work out in 2023. However, as we've seen recently, more regulations will likely come to the crypto market.

While we've considered crypto's unforgettable moments of 2022, try studying the trend to make financial decisions in the coming year. Remember, do your research thoroughly, and don't get rugged.